Wolf Richter- July 11, 2021

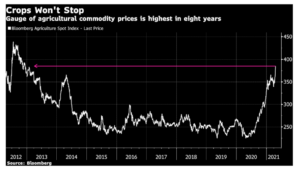

This year, inflation blasted off with a vengeance, and the last four months have seen the hottest pace of inflation since the 1980s.

The consumer price index – the CPI – rose 5% year-over-year for May. The June reading will come out in a couple of days [update: June CPI came in at 5.4%]. 5% of annual inflation is bad enough. But the pace of inflation over the past four months has been much higher, clocking in at over 8% annualized.

Surely, some inflation measures will tick down in the near future, giving everyone false hopes, before rising again. The first bout of inflation always looks temporary. But during those first bouts of inflation, that’s when the triggers of “persistent” inflation – namely the inflationary mindset and inflation expectations – are being unleashed.

So now the Fed keeps repeating time after time that this is temporary and that it will go away on its own because it was caused by temporary factors, namely a demand shock that occurred because the government spread $5 trillion in borrowed stimulus money since March last year; and because the Fed printed $4 trillion over the same period and repressed interest rates to 0%.

This moolah stimulated consumption, in a huge way, and it caused a historic spike in demand for goods, and there are now cascading shortages from ammo to semiconductors, made worse by container shortages and transportation bottlenecks.

But the fiscal and monetary stimuli are still ongoing. The government and the Fed still have the foot fully on the accelerator.